$$

$$$ Now $

$ Hear This: $

$ Money is debt. $

$ No debt, no money. $

$ Less debt, less money. $

$ Less money, less inflation. $

$ Even less money, is deflation. $

$ Because $

$ "Inflation is always and everywhere $

$ A monetary phenomenon." $

Milton

Friedman

(Money Tree from Sudden Debt)

Fed May Cut Rate Below Inflation, Risking Bubbles (Update3): “The Federal Reserve may push interest rates below the pace of inflation this year to avert the first simultaneous decline in U.S. household wealth and income since 1974.

The threat of cascading stock and home values and a weakening labor market will spur the Fed to cut its benchmark rate by half a percentage point tomorrow, traders and economists forecast. That would bring the rate to 3 percent, approaching one measure of price increases monitored by the Fed.

“The Fed is going to have to keep slashing rates, probably below inflation,” said Robert Shiller, the Yale University economist who co-founded an index of house prices. “We are starting to see a change in consumer psychology.”

So-called negative real interest rates represent an emergency strategy by Chairman Ben S. Bernanke and are fraught with risks. The central bank would be skewing incentives toward spending, away from saving, typically leading to asset booms and busts that have to be dealt with later.

Negative real rates are “a substantial danger zone to be in,” said Marvin Goodfriend, a former senior policy adviser at the Richmond Fed bank. “The Fed's mistakes have been erring too much on the side of ease, creating circumstances where you had either excessive inflation, or a situation where there is an excessive boom that goes on too long.””

They really don’t have any other kind of strategy.

This time I believe it will be different. The average American consumer has hit that ‘debt saturation’ point. Lower rates will not act as an incentive to increase spending simply because people can’t and increasingly because they don’t want to. There has been a rapid change in consumer psychology. Perhaps it has started to dawn on those legions of Baby Boomers that they may just have fucked themselves out of retirement.

It happened in Japan. They had savings to fall back on… and look what happened there.

Fed May Cut Rate to 3%, Hold Out Chance of More Cuts (Update1): “The Federal Reserve may lower interest rates for the second time in nine days and indicate a readiness to go further if the economy deteriorates.

The Federal Open Market Committee, ending a two-day meeting today, will probably follow the Jan. 22 emergency reduction with a half-point cut in its benchmark rate, according to 48 of 85 economists surveyed by Bloomberg News. Such a move would bring the rate to 3 percent.

Officials may cite “appreciable” risks to growth, a word used for the first time last week, avoiding what analysts said were the mistakes of 2007's statements. Through December, the FOMC referred to ``inflation risks,'' confusing some investors about its intentions. To avoid the impression of a blank check, Chairman Ben S. Bernanke will also seek language that notes the cumulative cuts since September, Fed watchers said.

“The statement will have a soft bias,'' said Brian Sack, a former research manager at the Fed's monetary affairs division, and now senior economist in Washington at Macroeconomic Advisers LLC. ``It certainly won't promise additional rate cuts, but it will talk enough about downside growth risks to leave that option open.”

The Fed's announcement is scheduled for about 2:15 p.m. in Washington. While most economists predict a half-point move, 21 in Bloomberg's survey forecast a quarter-point cut, one called for 0.75 percentage point and 15 saw no change.

Traders estimated a 70 percent chance of a half-point move and 30 percent odds on a quarter-point, based on futures prices on the Chicago Board of Trade. Treasuries rose on speculation of another rate cut with notes falling for the first time in three days.”

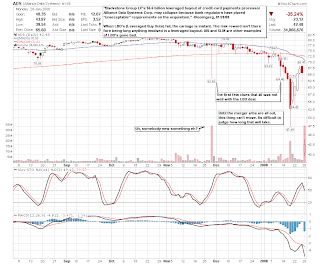

See the attached charts from the Federal Reserve Bank of St. Lious. You don’t need to be much of an expert really to see that something terrible is amiss. (I am NOT an expert on the banking industry, banking reserve requirements or the Federal Reserve banking system.) I can definitely see that in order to maintain banking reserve requirements a record amount of money is being borrowed from the TAF (Term Auction Facility). I can also see that the sudden increase in debt destruction is affecting the monetary base.

In the land of economics, debt and money are “fungible”. That simply means they are interchangeable and for all intents and purposes the same. Debt is money and money is debt. The sudden rapid destruction of debt (every write down you hear coming out of the financial sector) has the effect of destroying money. If debt is destroyed fast enough, and it will be, then you get a rather sudden contraction in money supply. This is known as DEFLATION… and it ALWAYS happens when a debt bubble bursts. ALWAYS.

It happened in the early 1930’s after the roaring 20’s sent consumer and corporate debt levels to record levels measured as a percentage of GDP. It has happened after every economic cycle since with the exception that the Central Banks of the world have always been able to inflate fast enough to offset the deleterious effects of credit destruction. Not this time. This time all major collateral has been leveraged and major forms of debt securitized. There are no other major assets left to employ as collateral. This time, there is no way to inflate fast enough.

… and so Bernanke, an expert on the Great Depression, will cut and will cut furiously.

A speech by Bernanke in May 31, 2003: Some Thought on Monetary Policy in Japan: “Rather, I think the BOJ should consider a policy of reflation before re-stabilizing at a low inflation rate primarily because of the economic benefits of such a policy. One benefit of reflation would be to ease some of the intense pressure on debtors and on the financial system more generally. Since the early 1990s, borrowers in Japan have repeatedly found themselves squeezed by disinflation or deflation, which has required them to pay their debts in yen of greater value than they had expected. Borrower distress has affected the functioning of the whole economy, for example by weakening the banking system and depressing investment spending. Of course, declining asset values and the structural problems of Japanese firms have contributed greatly to debtors' problems as well, but reflation would, nevertheless, provide some relief. A period of reflation would also likely provide a boost to profits and help to break the deflationary psychology among the public, which would be positive factors for asset prices as well. Reflation--that is, a period of inflation above the long-run preferred rate in order to restore the earlier price level--proved highly beneficial following the deflations of the 1930s in both Japan and the United States. Finance Minister Korekiyo Takahashi brilliantly rescued Japan from the Great Depression through reflationary policies in the early 1930s, while President Franklin D. Roosevelt's reflationary monetary and banking policies did the same for the United States in 1933 and subsequent years. In both cases, the turnaround was amazingly rapid. In the United States, for example, prices fell at a 10.3 percent rate in 1932 but rose 0.8 percent in 1933 and more briskly thereafter. Moreover, during the year that followed Roosevelt's inauguration in March 1933, the U.S. stock market rallied by 77 percent.”

Other great Blog posts on the topic:

Bank Reserves Go Negative

Money Does Not Grow On Trees