1265 was a big support level in the S&P 500 cash market. Once it broke, EVERYTHING sold off quickly and fiercely...

1265 was a big support level in the S&P 500 cash market. Once it broke, EVERYTHING sold off quickly and fiercely...All sectors, energy (XLE), finance (XLF), basic materials (XLB), industrial (XLI) and consumer discretionary (XLY).

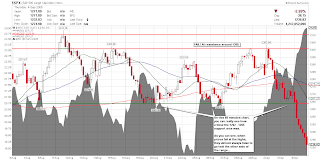

On this 60 minutes chart, you can really see how critical the 1262 - 1265 support area was and how violent the move was on the break…

On the daily chart prices broke out of the Bear Wedge, and drifted sideways after finding support around the 1265 area. We can now safely say, prices have broken DOWN and OUT.

This move should take prices to the lows around 1200 before even attempting a bounce. Most likely, momentum will carry prices right through the lows…

Non-farm payrolls could make or break this move. I’m thinking make… say good bye to the ‘12’ handle and go introduce yourself to the '11's.

3 comments:

I kind of think a retest of the low and then a policy induced ( Hanky Panky) short covering rally around the 16th are in the cards which seems to be the modus operandi with those guys.

anonymous,

you mean on option-expiration week? Noooo, I don't believe you, that would be legalized fraud...

On a second thought, I think I'll have my puts covered by then...

I suspect a double bottom at 1225, but if the current support does fail it looks like we're headed to 1175. Either way though, I think this is going to be the final bottom we're looking for. Right now it seems like lots of people are just sitting on the sidelines and I don't think it will stay that way for long.

Post a Comment