“Inflation is always and everywhere a monetary phenomenon.” –Milton Friedman

“Inflation is always and everywhere a monetary phenomenon.” –Milton Friedman

This would be funny if it wasn’t so sad.

In a misguided attempt to tame inflation (which is always and everywhere a monetary phenomenon) all futures trading in certain select commodities was banned in India back in May. Unexpectedly, this ban has now been extended to Nov. 30th.

First, this CANNOT work. (I’ll leave it at that for now. I’m not getting into a debate over inflation on a Friday afternoon.) Second, it did NOT work. So why bother extending the ban? Why for DEMOCRACY of course. The powers that be in India are facing an election. I think Winston Churchill had it right when he said, “The best argument against democracy is a five minute conversation with the average voter.”

India isn’t alone. Just recently the clowns over in Pakistan had a similar brain fart. Pakistan: Has Dumbest Idea, Sets Floor for Stocks. That will work out just as well…

Anyways, the long run economic consequences of disrupting the futures market like this will be massive. Producers can’t hedge. Suppliers can’t hedge. Everybody is exposed. A complex economy also requires clear and transparent rules that don’t just suddenly change. Larger, more complex enterprises need to be able to plan and require a predictable regulatory framework. Price discovery is now impossible. The result will be a massive supply and demand imbalance and a dead weight loss large enough to cripple an entire economy.

The big sucking sound you’re hearing off in the distance is the sound of institutional money fleeing India. (The same money fled an unpredictable and bellicose Russia over the last month.) These are the risks of getting into the BRIC (Brazil, Russia, India, and China) markets. You just can’t predict what economically illiterate politicians might do.

This also demonstrates just how fragile capitalism and globalization really is in these countries.

India Unexpectedly Extends Ban on Four Commodities (Update1): “India, the world's second-largest importer of vegetable oils, unexpectedly extended a four-month old ban on futures trading in soybean oil, rubber, potatoes and chickpeas to cool inflation holding at a 16-year high.

The ban has been extended till Nov. 30, said Anupam Mishra, director at the Forward Markets Commission, the commodity market regulator. The decision comes a day after a top official at the federal consumer affairs department, Yashwant Bhave, said it hadn't recommended prolonging the ban, which ends tomorrow.

Prime Minister Manmohan Singh's government faces elections in less than a year and higher prices can influence poll results. The Congress party-led coalition halted futures trading in wheat and rice last year, and lentils in 2006, to keep prices of food affordable.

“As long as inflation remains a concern, it would be difficult for the government to remove the ban,” said Naveen Mathur, head of Mumbai-based Angel Commodities Broking Pvt. “The market sentiment, already at a low, will take a further hit.”

The ban was imposed on May 7.

India's inflation rate has more than tripled this year, driven by surging global prices of crude oil and commodities. Benchmark wholesale price index gained 12.34 percent in the week ended Aug. 23, more than double the central bank's 5 percent target, government figures showed yesterday.

“The decision to extend the ban has been taken as a measure of abundant caution,” Rajeev Agarwal, member of the Forward Markets Commission, said in a telephone interview. “They have taken into consideration the government's concern on inflation.”

The Congress party-led coalition had banned exports of rice, corn, wheat and cooking oils to tame prices.

The trading restriction should be lifted because the measure failed to cool prices, B.C. Khatua, chairman of the Mumbai-based commodity markets regulator, said in an interview July 17. The comment echoed that of a government-appointed panel, which in April said it found no conclusive evidence to suggest futures trading fueled price increases.

Natural rubber prices in India have risen 12 percent since the ban was imposed in May, while soybean oil and chickpeas have risen 4 percent each, according to data from commodity exchanges. Only potato prices have fallen 18 percent.

The Multi Commodity Exchange of India Ltd. and the nation's other exchanges may need at least one month to resume trading in the banned commodities as contracts need to be reworked and fresh approvals from the regulator are required, Agarwal said.

Turnover on India's 22 commodity bourses rose 40 percent to 16.5 trillion rupees ($369 billion) in the four months ended July from a year ago, according to the regulator. Trading value jumped 11 percent to $922 billion in the year ended March 31.

Domestic traders, producers and consuming companies are the main participants in India's commodity exchanges, compared with the 13 million people in the country who trade stocks. Overseas funds aren't allowed to trade commodity futures.”

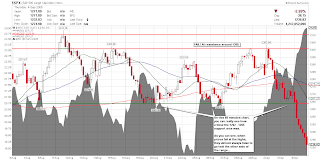

This last bounce was rejected at the declining 20 day EMA (blue line). Prices are now trapped below the 20, and 50 day EMAs (blue and red lines) with support at the 200 day EMA (green line). The last significant level of horizontal support is around $30. After that... who knows?

BTW, Milton Friedman was a monetarist.

Friday, September 5, 2008

India: Also Has Dumbest Idea, No More Commodity Futures

Posted by

Ben Bittrolff

at

3:33 PM

6

comments

![]()

Chinese Central Bank in Need of Capital

“It is as if China has made a gift to the United States Navy of 200 brand new aircraft carriers.” –Chinese Blogger

“It is as if China has made a gift to the United States Navy of 200 brand new aircraft carriers.” –Chinese BloggerWhen it rains, it POURS…

Main Bank of China Is in Need of Capital: “China’s central bank is in a bind.

It has been on a buying binge in the United States over the last seven years, snapping up roughly $1 trillion worth of Treasury bonds and mortgage-backed debt issued by Fannie Mae and Freddie Mac.

Those investments have been declining sharply in value when converted from dollars into the strong yuan, casting a spotlight on the central bank’s tiny capital base. The bank’s capital, just $3.2 billion, has not grown during the buying spree, despite private warnings from the International Monetary Fund.

Now the central bank needs an infusion of capital. Central banks can, of course, print more money, but that would stoke inflation. Instead, the People’s Bank of China has begun discussions with the finance ministry on ways to shore up its capital, said three people familiar with the discussions who insisted on anonymity because the subject is delicate in China.

[snip]

[snip]

For instance, a Chinese blogger complained last month, “It is as if China has made a gift to the United States Navy of 200 brand new aircraft carriers.”

Bankers estimate that $1 trillion of China’s total foreign exchange reserves of $1.8 trillion are in American securities. With aircraft carriers costing up to $5 billion apiece, $1 trillion would, in theory, buy 200 of them.

By buying United States bonds, the Chinese government has been investing a large chunk of the country’s savings in assets earning just 3 percent annually in dollars. And those low returns turn into real declines of about 10 percent a year after factoring in inflation and the yuan’s appreciation against the dollar.

The yuan has risen 21 percent against the dollar since China stopped pegging its currency to the dollar in July 2005.

The actual declines in value of the central bank’s various investments are a carefully guarded state secret.

Still China finds itself hemmed in. If it were to curtail its purchases of dollar-denominated securities drastically, the dollar would likely fall and American interest rates could soar.”

There really isn’t much to say except for, “Uh oh.”

Just like Bill Gross over at Pimco in Big Bet, Big Fail?, the Chinese put their full faith into the credit of the United States Government and bet the entire farm…

BRILLIANT. Just brilliant.

Posted by

Ben Bittrolff

at

8:34 AM

6

comments

![]()

Bear Wedge: Breakout

1265 was a big support level in the S&P 500 cash market. Once it broke, EVERYTHING sold off quickly and fiercely...

1265 was a big support level in the S&P 500 cash market. Once it broke, EVERYTHING sold off quickly and fiercely...All sectors, energy (XLE), finance (XLF), basic materials (XLB), industrial (XLI) and consumer discretionary (XLY).

On this 60 minutes chart, you can really see how critical the 1262 - 1265 support area was and how violent the move was on the break…

On the daily chart prices broke out of the Bear Wedge, and drifted sideways after finding support around the 1265 area. We can now safely say, prices have broken DOWN and OUT.

This move should take prices to the lows around 1200 before even attempting a bounce. Most likely, momentum will carry prices right through the lows…

Non-farm payrolls could make or break this move. I’m thinking make… say good bye to the ‘12’ handle and go introduce yourself to the '11's.

Posted by

Ben Bittrolff

at

7:54 AM

3

comments

![]()

Thursday, September 4, 2008

Bill Gross: Big Bet, Big Fail?

I don’t like Bill Gross at all.

I don’t like Bill Gross at all.

Pimco: Treasury needed to stop asset deflation: “To stop a sell-off of debt and other assets, the U.S. government will have to bring in new policies to open up the Treasury Department's balance sheet, said the manager of the world's biggest bond fund on Thursday.

"If we are to prevent a continuing asset and debt liquidation of near historic proportions, we will require policies that open up the balance sheet of the U.S. Treasury," wrote Bill Gross, chief investment officer of Pacific Investment Management Co, or Pimco, in his September Investment Outlook.

"To ultimately stop this asset/debt deflation, a fresh and substantial new source of buying power is required," Gross wrote.

Across financial markets, liquidity is drying up and investors' risk appetites are "anorexic." Despite a recent resurgence in the stock market, asset prices are mostly falling, including those of commodities, Gross noted.

In this uncertain environment, private sector investors are increasingly reluctant to risk committing any more of their own capital, he added.”

You see, Bill Gross is balls deep into Fannie Mae (FNM) and Freddie Mac (FRE) agency debt. He bet big on a bailout that would make him whole. The rat-bastard will only make money if taxpayers get raped.

Pimco’s chief piles into mortgage debt: “Bill Gross, the manager of the world’s biggest bond fund, has switched gears to make a big bet on mortgage debt, almost tripling his holding of it to more than 60 per cent of the fund.

Mr Gross’s $130bn Pimco Total Return fund pulled sharply ahead of rivals in the past year after the manager predicted a housing downturn and sold out of housing-related securities and corporate bonds.

Mr Gross said his decision to raise exposure to mortgage debt in recent months was based on the US government’s implicit guarantee of Freddie Mac and Fannie Mae, the government-sponsored mortgage agencies.

“Government policy is moving to sanctify the status of the government-sponsored agencies. It became a question of which institutions would be sheltered by the government umbrella,” he said.

So far, the bet appears to be paying off.”

That was in May.

Haha. With spreads blowing out, Billy has to be feeling some serious pain right now. What if he was wrong and the government doesn’t make his positions whole? What if they bail out Fannie and Freddie but give all investors one hell of a haircut?

Maybe his “investment secrets” were nothing more than, “hang out with the right crowd and make sure they’ve got your back” and “if all else fails, get the taxpayer to bail you out of your underwater positions.”

Well, Billy has a big bet on. The big bet could result in a big FAIL.

For an amusing compilation of FAILS and EPIC FAILS click here.

For a sobering look at Fannie over at PaperEconomy: Ticking Time Bomb?: Fannie Mae Monthly Summary July 2008

Posted by

Ben Bittrolff

at

1:30 PM

10

comments

![]()

German Manufacturing: Longest-Ever Declining Streak

… EXTENDING THEIR LONGEST-EVER DECLINING STREAK…

… EXTENDING THEIR LONGEST-EVER DECLINING STREAK…

If you think equities can mount a serious rally from here, just because oil is down a bit, you’ve got to be nuts. The damage has been done. Its recession time.

German Orders Unexpectedly Drop, Extend Losing Streak (Update2): “German factory orders unexpectedly fell in July, extending their longest-ever declining streak and increasing the likelihood that Europe's largest economy is heading for a recession.

Orders, adjusted for seasonal swings and inflation, slid 1.7 percent from June, the Economy Ministry in Berlin said today. Economists expected a gain of 0.3 percent, the median of 35 forecasts in a Bloomberg News survey showed. Orders slid 0.7 percent from a year earlier.

Germany's economy contracted 0.5 percent in the second quarter and may not recover in the third as exports falter and consumer spending slumps. Even though oil prices have retreated 24 percent since a July record, business confidence declined to a three-year low last month and consumer optimism fell to the lowest level in five years.”

Posted by

Ben Bittrolff

at

9:02 AM

5

comments

![]()

Financials: Where Will the Rally Stop?

Cobra over at Cobra’s Market View raises a very interesting point: “Look at this chart, XLF has rallied for 6 six days and this never happened before. I feel reluctant to say it is overbought and due for a pullback tomorrow. But in term of probability the pullback will happen for sure. I don't know if XLF can help the broad market to rally. If it pulls back, how can the whole market rally?”

Cobra over at Cobra’s Market View raises a very interesting point: “Look at this chart, XLF has rallied for 6 six days and this never happened before. I feel reluctant to say it is overbought and due for a pullback tomorrow. But in term of probability the pullback will happen for sure. I don't know if XLF can help the broad market to rally. If it pulls back, how can the whole market rally?”Click here for Cobra’s annotated chart of XLF.

The Philadelphia Bank Index (BKX) is sitting at the trop of its trading range. After being up the last five of six trading days, BKX is shooting into overbought territory. Overbought conditions didn’t last long the last few times during this general down trend. MACD is registering a decrease in upward momentum.

With a little more time, a confluence of resistance put a lid on prices around the $75.00 area. The declining 200 day EMA (green line) and the declining trend line (black) will converge upon resistance around $75.00 (horizontal red).

For any of this to come into play, BKX must first break out of the current trading range of about $71.00.

Regional Banks (KRX) bounced 60% from about $44.00 to about $71.00. The declining 200 day EMA (green line) acted as resistance. As long as the recent high of $71 holds, expect an eventual test of the lows around $45.00.

The ProShares Ultra Short Financials (SKF) is sitting on support between $106 and $110. (Remember, this is a derivative of a derivative and as such technical analysis isn’t nearly as reliable.) It currently looks like prices have popped temporarily below the 200 day EMA (geen line) like they did twice before.

Current price action does not yet concern me. A decisive close below $106 would give me pause. Realistically, SKF would have to break through the last major low around $90 before the ‘Bear Market’ in Financials can be challenged. Obviously, not many a trader would be able or interested in holding to that point…

BAC is going to come up against a confluence of resistance around $34.00 where outright resistance (horizontal red line), the declining trend line (black line) and the declining 200 day EMA will all meet up. With prices now overbought, and up volume still anemic, it is probable that resistance will hold.

Posted by

Ben Bittrolff

at

8:48 AM

3

comments

![]()

Wednesday, September 3, 2008

Financial Ninja Favs: August

In case you missed them, here are YOUR favorite Financial Ninja posts for the month of June:

1) Lehman To Be Acquired by Tooth Fairy

2) Freddie, Ambac, Morgan: This is the Sound of Credit Crunch

3) Another Bear Wedge, Financial Overbought

4) Fannie and Freddie: Poker, Bazookas and Paulson

5) US Treasuries, US Dollar and Commodities

The most popular post was about Lehman (LEH) from the WSJ. Although meant to be funny, it really does illustrate just how badly this crisis is being handled by the gang in Washington, and how badly everybody else is still hoping that ‘everything will be alright’.

Fannie Mae (FNM) and Freddie Mac (FRE) damn near imploded in August with traders jamming down both common and preferred prices. This inspired the now infamous brain fart from Hank Paulson; “If you've got a squirt gun in your pocket, you probably will have to take it out. If you have a bazooka in your pocket and people know it, you probably won't have to take it out.”

Financials did manage to rally most of the month as commodities collapsed. Oil lead the way down and the US dollar went parabolic on frenzied short covering.

Posted by

Ben Bittrolff

at

10:34 AM

8

comments

![]()

Desperate Lehman Turns To South Korean Military Fund

Huh?

Huh?

If this gets by the regulators, it would make absolutely clear just how desperate Lehman (LEH) is…

South Korea fund could join KDB in Lehman deal: “South Korea's military savings fund would consider joining Korea Development Bank in a bid for Lehman Brothers (LEH.N: Quote, Profile, Research) if KDB made such an offer, as now appears a good time for U.S. investments, the fund's chairman said on Wednesday.

State-owned KDB confirmed on Tuesday it was in talks with the struggling U.S. bank over a possible joint investment with other Korean banks. But South Korean banks rumored to be joining the KDB bid consortium denied on Wednesday they were involved.

[snip]

[snip]

The military fund, with $7 billion in assets, is a major South Korean financial investor in M&A deals, behind the National Pension Service and the Korea Teachers Pension Corp.

The fund, controlled by the defense ministry, has invested 300 billion won ($261 million) in Britain's Thames Water which provides drinking water and wastewater services. The 7 percent stake yields returns of more than 11 percent annually.

[snip]

[snip]

The Military Mutual Aid wants to secure more cash and liquidity amid the global credit crunch and slowing economies, while it has been diversifying into energy, resource and infrastructure projects in Laos, Kazakhstan and Russia.”

I’d imagine that these guys would bring a certain level of discipline to Lehman...

(Hat tip MacroMan)

Posted by

Ben Bittrolff

at

9:03 AM

3

comments

![]()

Down Oil Won't Save The Bulltards...

Oil peaked at $147 (grey, area) and equities (SPX, candle) hit bottom. It is clear, that the fuel for this rally in equities is the decline of oil prices specifically and commodities prices more generally. Unfortunately, the Bulltards have misunderstood (again). A declining commodity complex is not 'good for the consumer' (although that is true in the longer term). In this case, right now, commodity prices are signaling a serious and sudden halt in GLOBAL ECONOMIC GROWTH. Ultimately this is BEARISH for those very same equities currently rallying...

Oil peaked at $147 (grey, area) and equities (SPX, candle) hit bottom. It is clear, that the fuel for this rally in equities is the decline of oil prices specifically and commodities prices more generally. Unfortunately, the Bulltards have misunderstood (again). A declining commodity complex is not 'good for the consumer' (although that is true in the longer term). In this case, right now, commodity prices are signaling a serious and sudden halt in GLOBAL ECONOMIC GROWTH. Ultimately this is BEARISH for those very same equities currently rallying...On the S&P 500, this last high was a lower high. Prices failed to exceed 1313, stalling around 1309. Yesterday, despite a massive drop in oil, equities couldn't hold on to their gains, leaving a large SELLING TAIL on the candle.

Consequently, prices are going to plunge to the bottom of the trading range around 1262. From there, prices are likely to break down.

There is no leadership in the market. Financials (XLF) have popped on short covered and are now overbought and at resistance. Energy (XLE) was turned back at resistance is about to breakout OUT and DOWN. Consumer Discretionary (XLY) bounced on falling oil and is now at resistance. The consumer is dead. Cheaper gasoline won’t help you make your mortgage and credit card payments. Basic Materials (XLB) made a lower high. The fast money is coming out of all commodities. Industrial (XLI) are also making lower highs as it becomes apparent the rest of the world is slowing as well. All manufacturing will suffer.

Down oil won’t save the Bulltards…

Posted by

Ben Bittrolff

at

8:25 AM

2

comments

![]()

Tuesday, September 2, 2008

The Fed: The Battle Rages Within

The battle rages within…

Three Fed Banks Sought an Increase in Discount Rate (Update1): “One-quarter of the Federal Reserve's regional district banks lobbied to raise the discount rate in July, signaling rising pressure to increase borrowing costs to banks even as economic growth slows.

Citing a rising danger of inflation, the boards in Chicago, Dallas and Kansas City sought a quarter-point increase in the discount rate from 2.25 percent, according to minutes of officials' discussions prior to the Aug. 5 policy meeting that were released today in Washington. The other nine Fed district banks asked for no change, in line with the decision to keep the discount rate and benchmark federal funds rate unchanged.

The minutes indicate broader support for lifting interest rates than revealed by the tally at last month's Federal Open Market Committee meeting, where just one of the 11 members voted for an increase. The division comes as officials debate the likely impact of the retreat in commodities on consumer prices, which surged the most since 1991 in the year to July.”

It looks like not everybody is on the same page…

Will a divided Fed make a bad thing worse?

Posted by

Ben Bittrolff

at

3:33 PM

0

comments

![]()

Gustav Fizzles and Commodities Fail

Crude Oil, Gold Lead Decline in Commodities in London Trading: “Crude oil and gold led a decline in commodities in London as Hurricane Gustav spared the U.S. Gulf states the destruction caused by Katrina and Rita in 2005.

Crude Oil, Gold Lead Decline in Commodities in London Trading: “Crude oil and gold led a decline in commodities in London as Hurricane Gustav spared the U.S. Gulf states the destruction caused by Katrina and Rita in 2005.

The S&P GSCI index of 24 commodity futures has dropped as much as 7 percent in two days, to the lowest since April 2. Oil is trading at a five-month low, 27 percent below the record $147.27 a barrel reached July 11.

Workers from more than 70 percent of the platforms and rigs in the Gulf were evacuated as Gustav approached. All of the area's 1.3 million barrels a day of oil and 7.06 billion cubic feet of gas, 95 percent of the total, was shut. Royal Dutch Shell Plc, Total SA and ConocoPhillips said they were inspecting offshore U.S. Gulf platforms today.”

After oil failed to bounce beyond resistance around $120, prices quickly got trapped by the 20 and 50 day EMAs (blue and red lines). Support at the 200 day EMA (green line) will now come under attack.

Overnight and early this morning, WTIC went as low as $105.50…

Failure to stay above the $110 area would result in a rapid fall to $100.

DUG has pulled back and worked off the overbought condition. With oil falling below all support, DUG should move back up... and a test of the highs around $40 is in order.

SMN has sits trapped by the 20, 50 and 200 day EMA (blue, red and green). Prices have worked off the overbought condition. A pop higher on a stronger USD and weaker commodities is in order.

The breakout is likely to fail here. The TSX 60 (XIU) is commodity heavy and overbought. With oil and PM's dropping on a stronger USD, expect XIU to move back down and test the lows around $19.50. Canada can be played from the short side using the double inverse ETF HXD.TO.

Posted by

Ben Bittrolff

at

8:26 AM

4

comments

![]()